I’m the last registered socialist.

Today Prime Minister Carney announced that Canada will hit the NATO 2% of GDP target for military spending within the next year. This was inevitable, or at least moving in this direction was. It’s as close to a bipartisan issue within the NATO countries you could hope to find. It will help Canada’s credibility if we try to shore up defence agreements with Europe, as the USA starts indicating it doesn’t want to include us (or Europe based on the leaked signal chats) anymore.

As much as I might dream morally of a world with no need for military and war, we don’t live in that world. All evidence points to humanity being too confrontational for that message to hold long. Coca-Cola and Pokemon Go only brought us together for so long.

From the Coca-Cola website themselves, “I’d like to buy the world a coke” Ad from 1971. At least Pokemon Go brought us together a bit more organically.

So defence spending will have benefits in certain places and to certain people. Like any government spending that isn’t just sent to the shadow realm.

But turning government spending into more government revenue is a trick only a tax collection agency can pull. So this spending will either increase the deficit, require new taxes, or require cuts elsewhere. Carney indicated cuts elsewhere were likely. After all, he has just cut taxes. Everyone is cutting taxes. Because cost of living is rapidly reaching levels of unbearable and a large cohort of people might revolt if nothing happens to bring it down.

In the short term this is fine. In the long term we might be kicking a debt crisis down the road where tough decisions will be made at the expense of a lot of people. Again. Recessions are cyclical. Hurrah.

What seems to baffle us about the economy we created is how to fairly tax income, sales, investments, and corporations. As long as we don’t pull a Romney and get people and corporations confused the answer to this seems to depend entirely on what you hold. Income and sales taxes impact the lower wealth bracket of working age people, most which seems to be the driver of all the recent tax cuts. Capital gains on investments were pitched to be raised, but that was a different Prime Minister so that has since been scraped. Investments do benefit people besides the rich, if you have parents thinking about retirement they are probably relying on them at least partially. Like the cost of housing, once you own them you don’t really want the price to go down or taxes to go up. And I doubt most economic analysts would recommend raising taxes on corporations during a trade war against an American president trying to get them to leave our country for the USA.

What about wealth? This would probably be the most popular among the general population if we can find a way to do it. Easier said then done I’m sure, since corporations with a lot of money have figured out ways to avoid paying taxes by moving country flags around like a cruise ship. I love a good race to the bottom. It would at least be worth figuring out a method to prevent rich people from taking out loans against their assets, which isn’t taxed since they never sell anything and loans aren’t taxed. Neat trick with Twitter Elon, I wish you nothing but the worst with your Trump breakup.

So income and sales taxes went down and… nothing else really changed. So government income is lower… and spending is going to be higher. Unless we create growth.

From halifaxharbourbridges.ca Removing the tolls on the harbour bridges has benefited me but it will cost the province, and thus all provincial taxpayers.

How do we create that growth? Well resources tend to be taxed differently, companies can’t really bypass resource revenue but it isn’t stable since it depends on the price of the resource. But still, it’s a guaranteed winner for a government looking for more income. Thus the incentive to chase what’s in the ground.

Do we need more investment? More entrepreneurs? I don’t know, I’m an idiot and would need some experts to advise on what’s possible and advisable. But as someone firmly within the working age that income matters, maybe we should have given the capital gains increase a try.

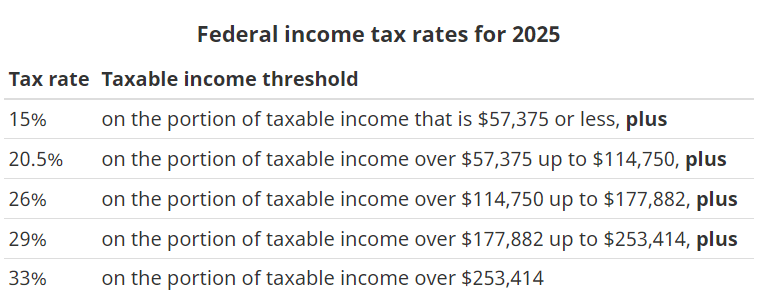

And Now, An Aside on Marginal Income Tax Brackets

If you aren’t aware of how income taxes work in Canada it’s worth knowing the basics of marginal income tax brackets. A salary increase is ALWAYS WORTH TAKING, your take home pay will go up no matter how close you are to the next bracket. There is an argument for some people to chose between overtime pay vs time off in lieu, but that’s a calculation of how much the extra time off is worth to you compared to the money.

A flat tax is a scheme by the rich to make themselves richer.

Notice how these are bands. If you made $300k in income, you only get taxed 33% on the last $43k of your income ($300k-$253k). Note this only federal tax rates, but provincial income taxes work the same way.