ExxonMobil Leaves Loves Canada!

You can’t make us pay to clean this up once we’re done either.

We at ExxonMobil would like to remind Canadians that as the owner of 70% of Imperial Oil we call all the shots. Including inserting all the highest executives. And at Imperial Oil (and/or ExxonMobil depending on any legal issues that may or may not arise, we are legally two different companies, don’t get it twisted) we believe our people are our greatest strength.

As long as they don’t cost too much.

And while we might be legally and realistically obligated to keep a certain number of operators and technicians to keep a plant running we realized that design, optimization, and compliance are huge areas to potentially streamline our operations. And we are passing the savings on to you, the shareholder! So it is with great pride we announce that we have the privilege of laying off 900 Canadians.

You are a shareholder right? We wouldn’t want to miss out on this golden opportunity!

We have spent the last 5+ years innovating the art of offshoring jobs. Conventional wisdom said that natural resource jobs seem land locked to the country they are found within. But we wanted to think bigger and leverage our position as a global mega corporation to take those good paying jobs and put them in India instead! Because those good paying jobs don’t pay as well there! Did you think your family member who went for an engineering degree had safe job prospects? Not if we can help it. Tell them to buy stocks.

We all have to face the hard facts that despite Canada’s oil and gas sector making money, it simply doesn’t make as much as it could. Like it does in other countries that are easier to plunder. Canada needs to look inwards and ask how it can make itself competitive in the global market. The cost of Canadian workers is just not something our shareholders can bear.

We look forward to not having to pay the retirements we promised those employees when they joined. It’s a harsh world for anyone without capital. Our company knows this because we worked hard for our capital by destroying the global climate. The people we grace with continued employment will just have to work harder to pick up the slack of two other workers. The sense of pride and accomplishment they get for their works will no doubt improve their lives.

We will usher in a new era of Christian work ethic!

For the poor.

They should have been born rich, or have retired at age 55 in 2007.

Disclaimer:

The author of this post does not speak on behalf of ExxonMobil or Imperial Oil, which should be obvious from the content. The author merely wishes to express discontent that there never seems to be such a thing as enough profit, regardless of the lives upturned as a result. And a real government would not let those jobs be off shored to places that do not pay taxes or live in our communities.

Some true facts:

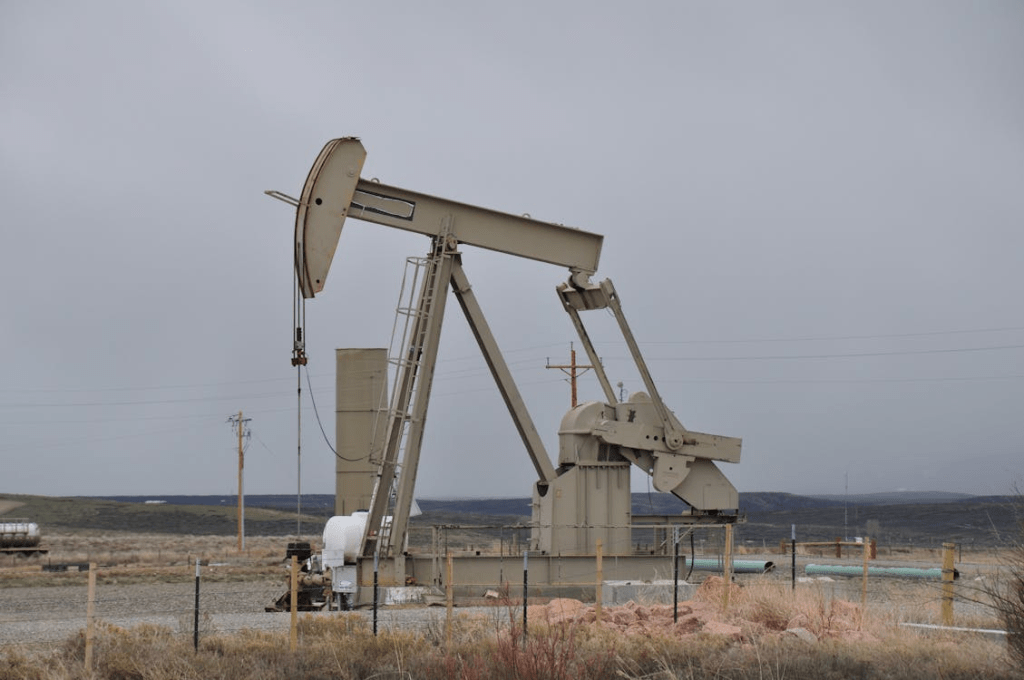

It is worth noting that less than two years ago Imperial Oil, in agreement with ExxonMobil as the primary shareholder, bought back approximately $1.5 billion in its own shares. A move one does when it has no interest in investing in anything but wants its share price to go up.

Imperial Oil has also been operating at a profit in the billions of dollars each year since 2021, with 2022 being a record year. But global oil prices have been slipping so it’s time for the chainsaw.